On a single day, millions of people from around the world struggle to make decisions about financial assets. Their struggle is on how to predict the direction in which the securities will move.

When their price moves higher, they profit by buying the securities. If they believe that the price of the securities will move lower, they sell short.

To do all this, the traders use a number of strategies. One of the most famous is to analyze a chart using Elliott Waves.

The first common strategy is on fundamental analysis. In this, they consider the relevant news and how they will impact the market. The other common strategy is on technical analysis. In it, the traders use one or a combination of the technical indicators that are provided by the brokers.

As a trader, your goal is to understand 2 or 3 strategies and use them for your daily trading. In addition, you can always define your trading strategy that suits your trading patterns.

This is probably what you all have been waiting for – drumroll please – using the Elliott Wave Theory in forex trading!

As an Elliott Wave trader, you will be spotting “wave counts.”

This means that you will be labeling the waves to see how they conform to the Elliott Wave pattern, to try and anticipate future price movement.

In this section, we will look at some setups and apply our knowledge of Elliott Wave to determine entry, stop loss, and exit points.

Elliott Wave Theory

Back in the old school days of the 1920 – 30s, there was this mad genius and professional accountant named Ralph Nelson Elliott.

By analyzing closely 75 years’ worth of stock data, Elliott discovered that stock markets, thought to behave in a somewhat chaotic manner, actually didn’t.When he hit 66 years old, he finally gathered enough evidence (and confidence) to share his discovery with the world.

He published his theory in the book entitled The Wave Principle.

According to him, the market traded in repetitive cycles, which he pointed out were the emotions of investors caused by outside influences (ahem, CNBC, Bloomberg, WSB) or the predominant psychology of the masses at the time.

Elliott explained that the upward and downward swings in price caused by collective psychology always showed up in the same repetitive patterns.

He called these upward and downward swings “waves”.

He believes that, if you can correctly identify the repeating patterns in prices, you can predict where the price will go (or not go) next.

This is what makes Elliott waves so appealing to traders.

It gives them a way to identify precise points where the price is most likely to reverse.

In other words, Elliott came up with a system that enables traders to catch tops and bottoms.

So, amidst all the chaos in prices, Elliott found order.

Of course, like all mad geniuses, he needed to claim this observation and so he came up with a super original name: The Elliott Wave Theory.

But before we delve into the Elliott waves, you need to first understand what fractals are.

What are Fractals?

Basically, fractals are structures that can be split into parts, each of which is a very similar copy of the whole. Mathematicians like to call this property “self-similarity”.

You don’t need to go far to find examples of fractals. They can found all over nature!

A seashell is a fractal. A snowflake is a fractal. A cloud is a fractal. Heck, a lightning bolt is a fractal.

So why are fractals important?

One important quality of Elliott waves is that they are fractals. Much like seashells and snowflakes, Elliott waves could be further subdivided into smaller Elliot waves.

How to Trade Forex Using Elliott Waves?

Scenario #1:

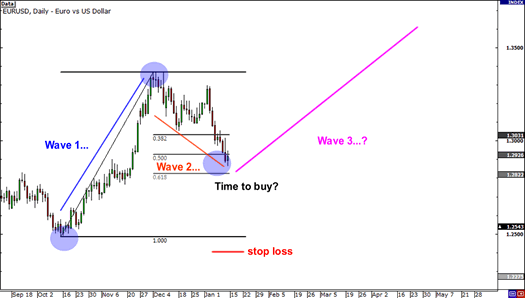

Let’s say you wanted to begin your wave count. You see that price seems to have bottomed out and has begun a new move upwards.Using your knowledge of Elliott Wave, you label this move up as Wave 1 and the retracement as Wave 2.

In order to find a good entry point, here’s what you found out:

- Rule Number #2: Wave 2 can NEVER go beyond the start of Wave 1

- Waves 2 and 4 frequently bounce off Fibonacci retracement levels

So, using your superior Elliott Wave trading skills, you decide to pop the Fibonacci tool to see if the price is at a Fib level.

Price is just chillin’ like ice cream fillin’ around the 50% level. This could be the start of Wave 3, which is a very strong buy signal.

Since you’re a smart forex trader, you also take your stop into consideration.

Cardinal rule number 2 states that Wave 2 can never go beyond the start of Wave 1 so you set your stop below the former lows.

If the price retraces more than 100% of Wave 1, then your wave count is wrong.

Let’s see what happens next…

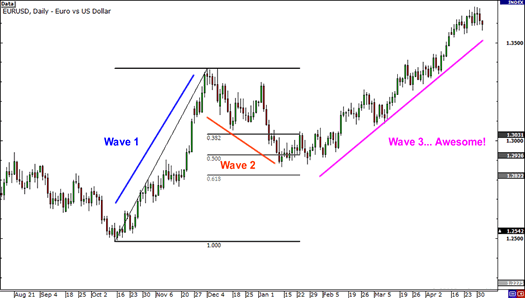

Your Elliott Wave analysis paid off and you caught a huge upward move!

Scenario #2:

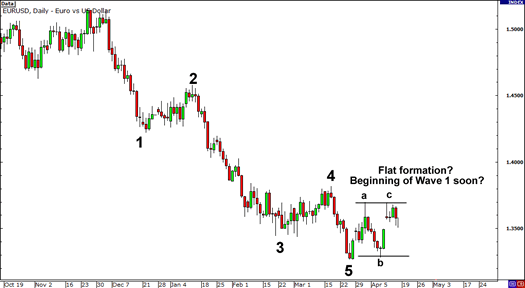

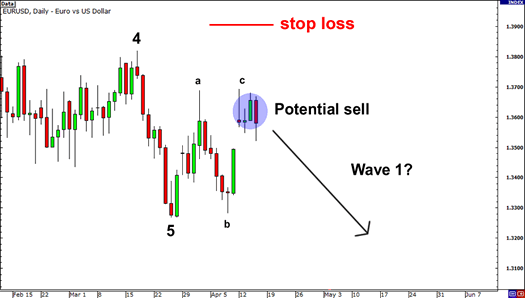

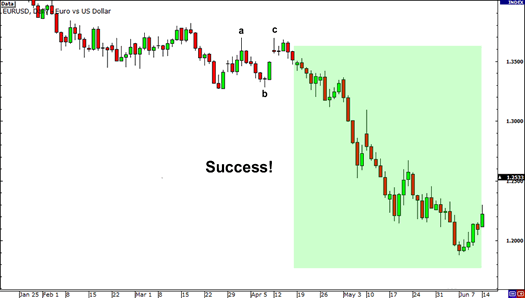

This time, let’s use your knowledge on corrective wave patterns to grab those pips.

You begin counting the waves on a downtrend and you notice that the ABC corrective waves are moving sideways.

Is this a flat formation in the works? This means that price may just begin a new impulse wave once Wave C ends.

Trusting your Elliott Wave skills, you go ahead and sell at the market price in hopes of catching a new impulse wave.

You place your stop just a couple of pips above the start of Wave 4 just in case your wave count is wrong.

Because we like happy endings, your trade idea based on the Elliott Wave Theory works out and nets you a couple of thousand pips on this day, which is not always the case.